how much tax do you pay for uber eats

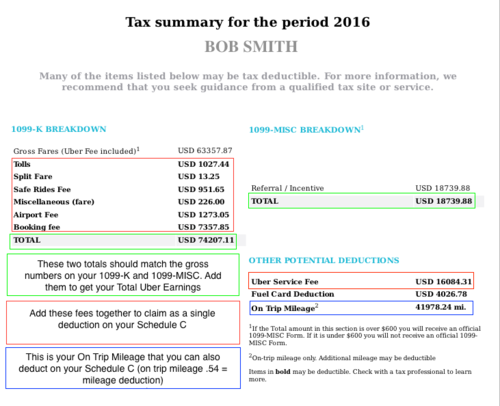

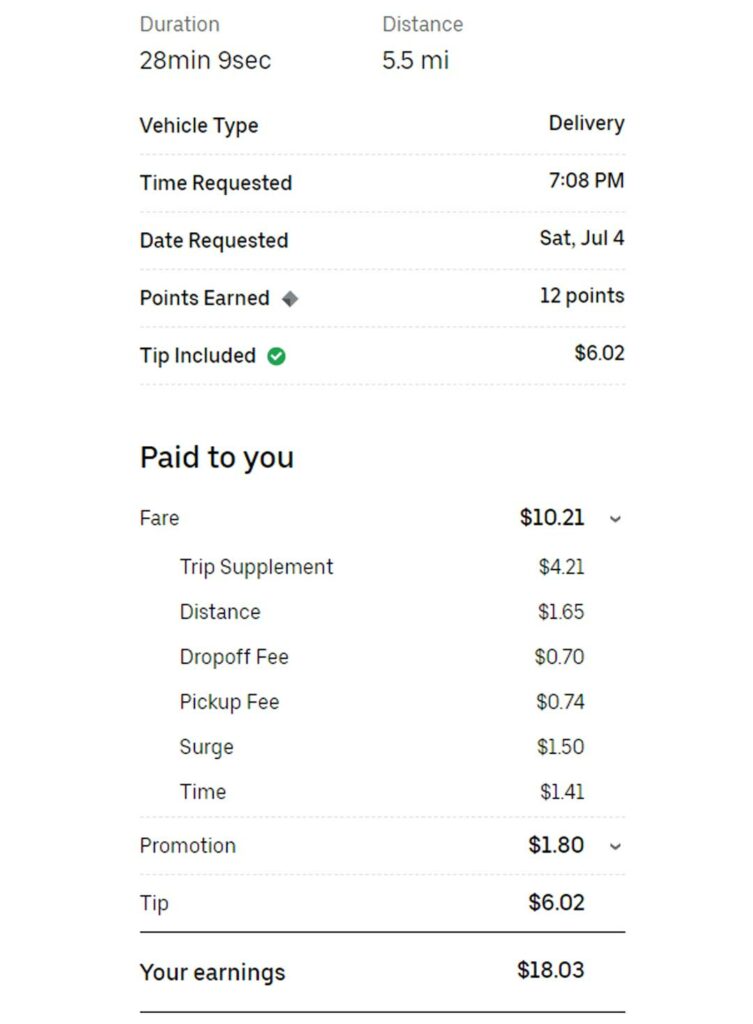

But the average income for delivery drivers in the United States is 15-18. Understanding your Uber 1099s.

The New Uber Eats Pay Model 7 Takeaways Entrecourier

So for example if you earn 30000 from your employee job and you have 5000 of Uber profits for.

. Uber Eats does not reimburse for driving meaning contractors pay those costs out of pocket. How do Uber Eats drivers get paid. You should file a Form 1040 and attach Schedule C and Schedule SE to.

Note that the rates below will be the same for the 2021-22 and 2022-23 financial years. If you had 20000 in earnings and 10000 in expenses your profit is 10000. According to testimonies of different distributors it can be concluded that in this type of food delivery applications an average of.

Driver Net GST Liability c 659. If your accounts for Uber Eats and Uber use a different email address your earnings from deliveries and rides will. Cash out your direct deposit account.

Thats why Uber doesnt. Your average number of rides. All you need is the following information.

The total income for a Uber Eats driver is not fixed and can vary for different individuals. Uzair July 24. Regardless of how much you make according to the ATO any income you earn as a food delivery driver must be declared on your tax return.

One source I saw notes that the national median as of early 2022 was 1774. The average pay for a single delivery starts at about 3. The first one is income taxes both on federal and state levels.

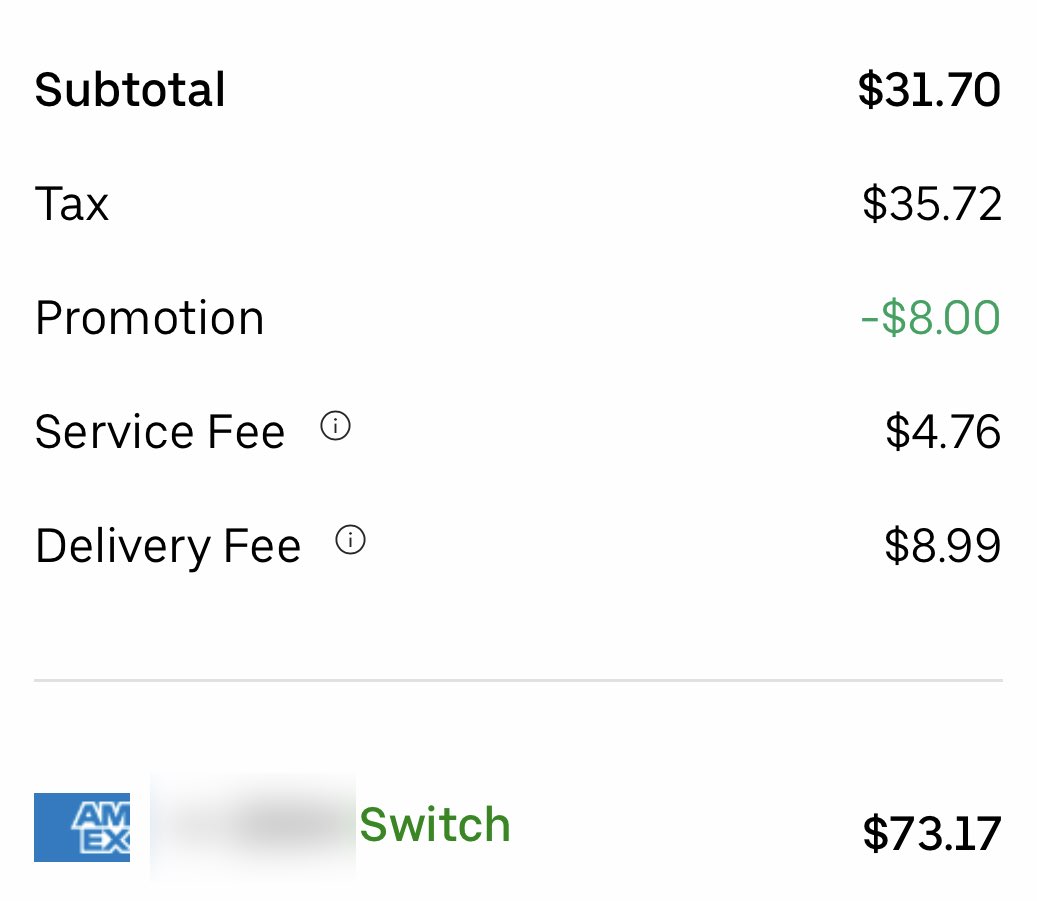

Your Ubereats taxes depend on your profit not on what you get paid by the company. Driver Output Tax Liability b 909. Your federal tax rate may range from 10 to 37 and your state tax rate can range from 0 to.

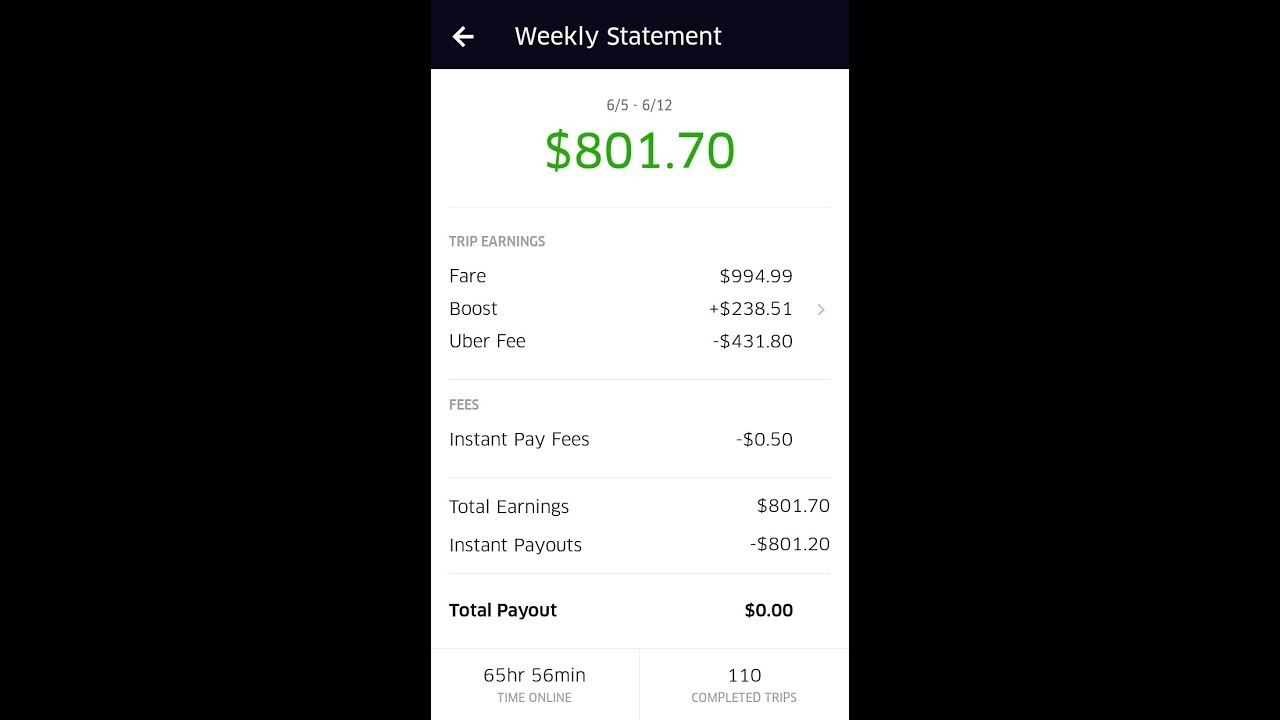

How Much Does Uber Eats Pay Per Delivery. Then you subtract the expenses from the income. The average number of hours you drive per week.

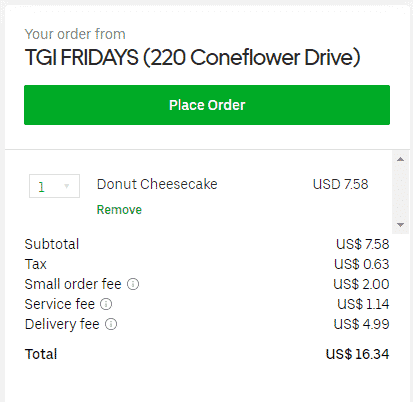

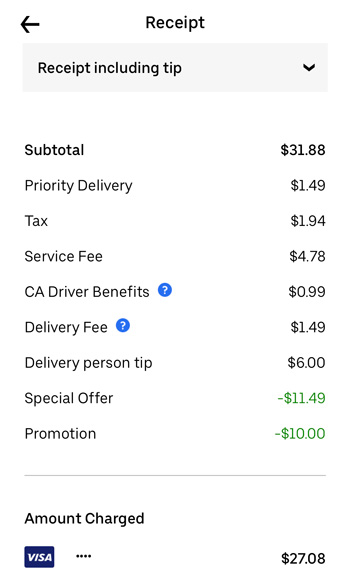

9 per hour if youre paying for your car through car finance. Base fare Trip supplement Promotions Tips Total. The money left over is the basis for your taxes.

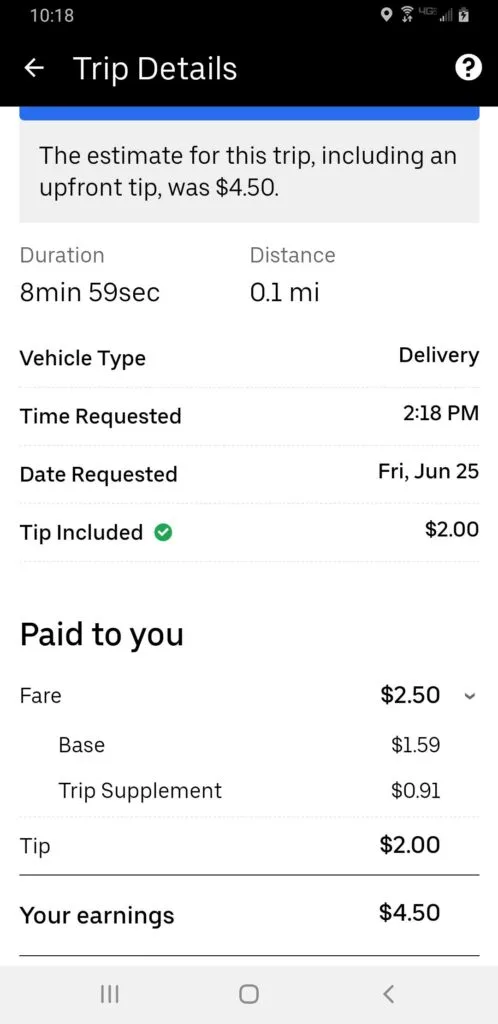

Using our Uber driver tax calculator is easy. Uber Eats drivers will receive a flat fee for. Uber Eats Pay Rate.

Clicking on the earnings tab. As an independent contractor you should set aside enough to cover the 153 self-employment tax and at minimum 10 federal income tax. If you are an Ubereats driver in the UK you will be required to file your tax returns and pay your income tax through the self-assessment.

Who pays more DoorDash or Uber Eats. As far as Uber is concerned youre an independent contractor who provides a service not an employee. Driver Outcome 6591.

My question is do i need. A The total amount received after the Service Fee is deducted. Yes Ubereats drivers pay taxes in the UK.

Is Uber tax free. For the majority of you the answer is yes If your net earnings from Uber exceed 400 you must report that income. For every dollar you earn in profit you will pay 153 self.

950 per hour if you drive your own car. How much do I owe in taxes Uber Eats. To avoid the estimated tax penalty you must pay one of the above.

110 of prior year taxes. How much money can I make with UBER Eats. AGI over 150000 75000 if married filing separate 100 of current year taxes.

Use business income to figure out your self. What the tax impact calculator is going to do is follow these six steps. How much should I set aside for taxes Uber eats.

On top of that you get a distance surge andor promo bonus added to the base price. For more information on how much tax youll pay check out or blog post on How Much Youll Actually Make Driving For Uber. You will receive one tax summary for all activity with Uber Eats and Uber.

Delivery driver tax obligations. You can transfer your earnings to a debit card up to five times per day with Instant Pay. Recently Ubers UK head of public policy Andrew Byrne revealed three typical hourly rates.

According to ZipRecruiter Uber Eats drivers earn an average of 41175 per year compared to DoorDash drivers 36565. Uber Eats pay rate is calculated using this formula. Estimate your business income your taxable profits.

Uber Taxes Explained How To File Taxes For Uber Lyft Drivers Youtube

How Do Food Delivery Couriers Pay Taxes Get It Back

Doordash Vs Uber Eats Ultimate 2022 Guide Which One Pays More

Doordash Vs Uber Eats Ultimate 2022 Guide Which One Pays More

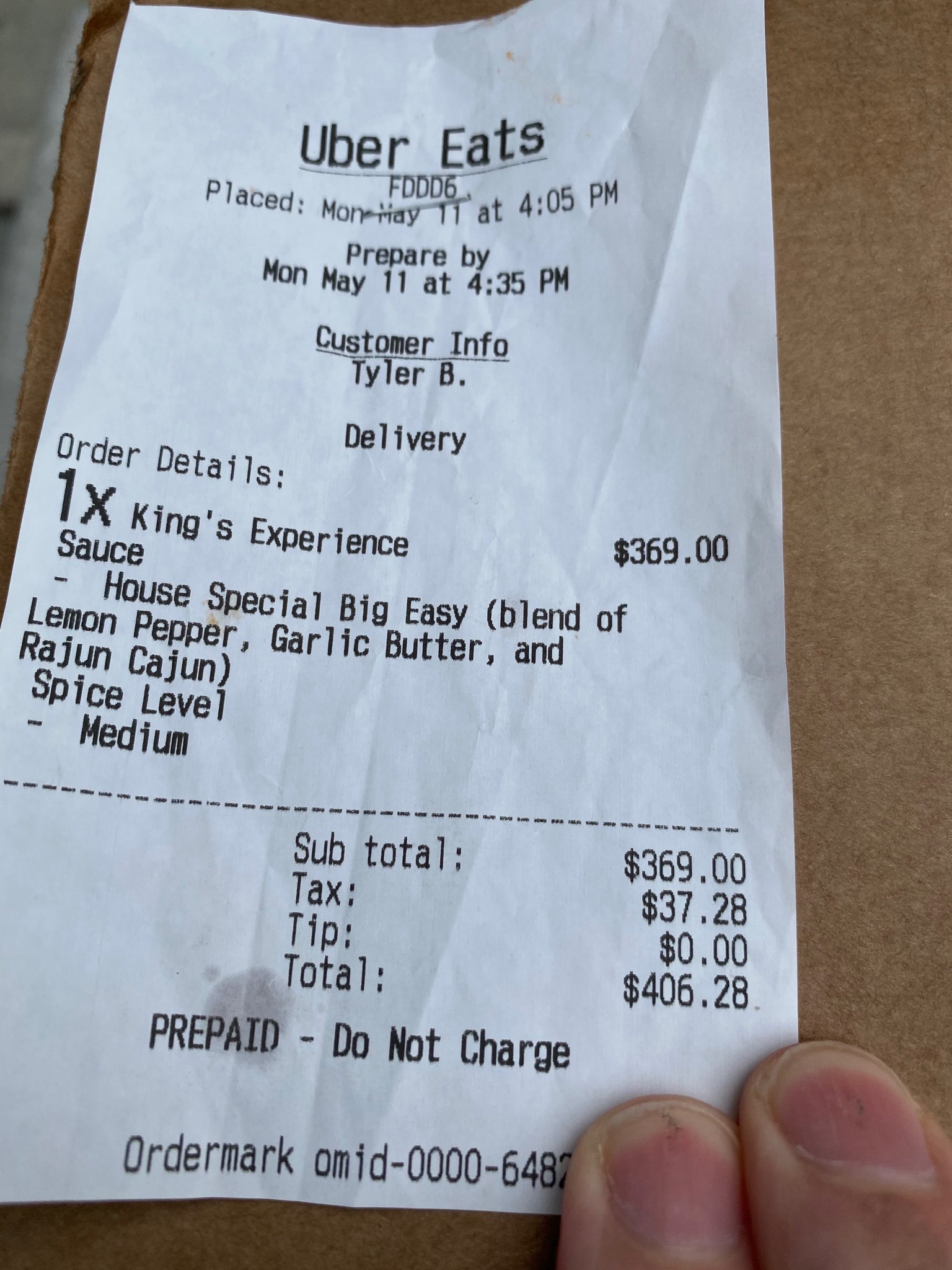

Working Washington On Twitter Here S An Uber Eats Driver Paid 10 To Deliver Almost 400 Of Food No Tip No Hazard Pay No Sick Days But Essential Https T Co G28mossjv1 Twitter

9 Concepts You Must Know To Understand Uber Eats Taxes Complete Guide

How Much Does Uber Eats Pay Your Guide To Driver Pay 2022

How Do Taxes Work With Ubereats Youtube

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

My Ubereats Earnings How Much Can You Make Per Week Driving For Ubereats Youtube

How To Enter Banking Information On Uber Eats Manager Uber Eats Youtube

Ben Sandofsky On Twitter Uber Eats Added A 110 Fee Under Taxes I Ve Had Zero Luck Getting An Explanation From Support Anyone Else Experience This Https T Co Zydjvn8uet Twitter

How Does Uber Eats Make Money Uber Eats Business Model Feedough

Highest And Lowest Uber Eats Driver Pay From 880 Week To 1 50 Orders Ridesharing Driver

How Much Does Uber Eats Cost And Learn How To Save On Orders Ridesharing Driver

How Much Does Uber Eats Pay Your Guide To Driver Pay 2022

How Much Do You Make With Uber Eats

You Can Now Order From Uber Eats And Expense It To Your Company Mashable